Crypto: Casinos Burn and Sink as Workers Make Shoes and Mine Coltan

First Half: SBF, CZ, the WEF, the United Nations, and the PRC

Thanks to all for the Subscriptions and to Substack for so much of Compassionate Information. This piece has taken over three weeks to complete. Day after day more was revealed about the astounding abuses that Centralized ‘Crypto’ Exchanges deal to ‘participants’ and to our Earth and especially to those who mine the metals and make the shoes that keep the whole Great Game and Con of 21st-century Colonial Empires going … to those Empire’s own, certain destruction. Now we know. Wherever we look into exploitation, fraud and lives ruined behind racist hubris, we see Governments compliant with Agendas of the United Nations, the World Economic Forum’s 100 Strategic Partners, and the 51 supranational Banks who share headquarters with the WEF and the WHO in Geneva, Switzerland. Now we know how and where the Always Partnered Enemies of humans’ freedom, cooperation and prosperity live. Think what our own tools and genius can do!

All six Parts of this piece are up on the Ur1Light site. I’ll publish it in on Substack in two Halves for easier, I hope, digeston. (It’s a purty dense ol’ piece.) Again, cheers and thanks to the great Substack community.

Part One: SBF, CZ, and the World Economic Forum

Part Two: Binance, FTX, and the CCP in Hong Kong

Part Three: The Casino Wins and Yet Fails and Falls

December 18, 2022

Part 1: SBF, CZ, and the World Economic Forum

Now, this day of middle December of 2022, some digging beyond the headlines and screens of Corporate State Big Media lets us see MORE of what's really going with the embroiled 'Crypto-Currency Exchanges' FTX and Binance and principals in them. We look here at Samuel Bankman-Fried ('SBF') and Caroline Ellison of FTX and at Chengpang ("C Z") Zhao and (most closely) Helen Hai of Binance.

Chengpang Zhao (CZ) and Sam Bankman-Fried.

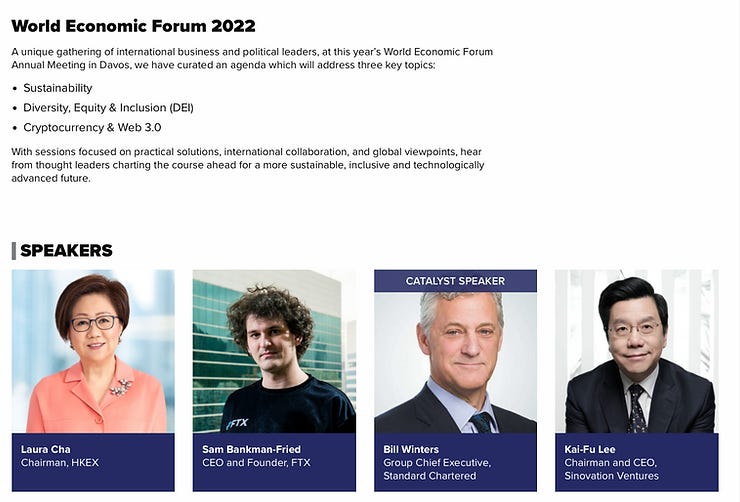

Last May, Sam Bankman-Fried, age 30, was ballyhooed by CSBM as having built a 'personal fortune' of $16 billion USD through FTX over the preceding three years, was a featured speaker at the World Economic Forum's in-person Annual Meeting in Davos, Switzerland. In WEF-Speak, SBF was among 'thought leaders charting the course ahead for a more sustainable, inclusive and technogically advanced future.' (1)

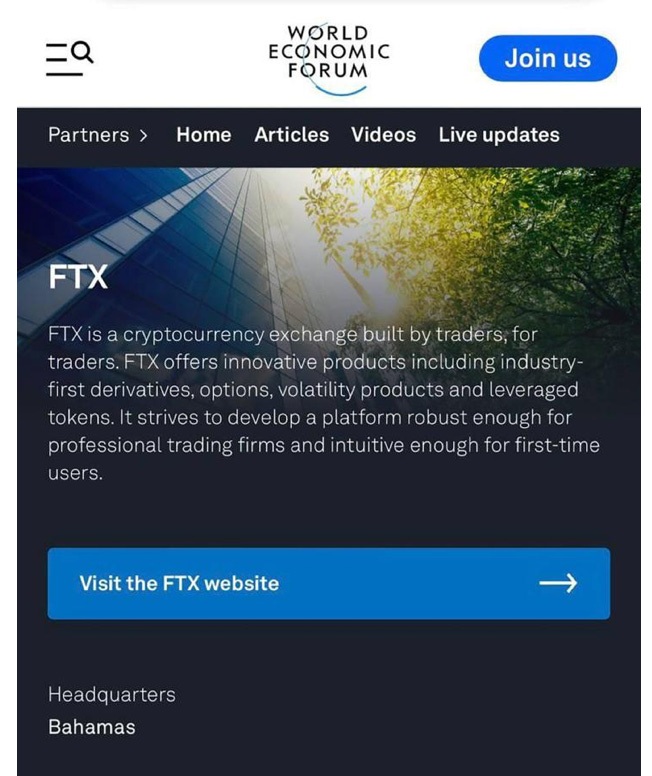

FTX then had an Evocative Tile that presented its Con-Game Gibberish in its New Role as a 'Partner' with the WEF. 'FTX offers innovative products including industry-first derivatives, options, volatility products and leveraged tokens.' Step right up for some of those 'industry-first derivatives, options, volatility products and leveraged tokens.'

The 'Downfall' of Bankman-Fried and FTX was chronicled hourly by CSBM (Corporate

State Big Media--and, yes, that BM has an intended, other meaning) on Tuesday and Wednesday November 8 and 9. FTX declared Bankruptcy and Bankman-Fried resigned as CEO on November 11. The WEF removed FTX from its website on November 14. CSBM has little notice of this deletion, but it's reported in The Gilmer Mirror of East Texas in the USA. (2)

The WEF is undeterred by FTX's 'Downfall'. The WEF has a larger, 'more inclusive'

Goal to ride and a Con-Game to sell. The WEF remains a staunch proponent of 'cryptocurrency.' On November 11 it posted 'Is cryptocurrency the future of finance?'

"Thank God for coincidence", Phil Ochs once sang about the CIA and Vietnam. (3)

Yes, on the same day as the Crash of FTX followed the gutting of many other Crypto exchanges in 2022. the WEF published a 'Study' that supported the WEF's Agenda of

transferring all of working-people's financial transactions--and money--into a Digital Metaverse, say, that's controlled by the biggest of international Banks--such as the 51 who share Geneva, Switzerland as their Headquarters. Bankers haven of Geneva is also Headquarters for the WEF and the United Nations World Health Organization.

The 'Study', sponsored by Grayscale, 'A Leader in Digital Investing' was grounds for the WEF to again hammer for policies exactly contrary to immediate realties (speculator crypto-currencies' failure) and humanity's well-being.

The WEF wrote (the bolding is mine): 'Ultimately, these results reveal that there is clear, broad bipartisan support for greater action in Washington to clarify and strengthen cryptocurrency rules and regulations, representing a rare opportunity for bipartisan efforts to succeed. The US has always been a leader in the global financial system, and its slow response to cryptocurrencies has threatened that position.... Crypto is here to stay, and is a topic that’s increasingly top of mind for future generations. The takeaways from this survey are a call to action to jurisdictions around the world. Governments need to act expeditiously to determine ways to support the continued growth of the crypto industry, while simultaneously protecting their citizens’ financial futures.' (4)

So, again, the WEF is here to 'support the growth' of an 'industry' (favored word of Binance's CEO Chengpang Zhao) that has in the past year wiped out more than half of its investors' money ... while the WEF also advocates for Governments to 'strengthen cryptocurrency rules and regulations ... simultaneously protecting their citizens’ financial futures.'

Again, the WEF wants to enlist humanity into Means of Robbing Ourselves through Centralized Control by Corporations Twained with Governments ... while its language, WEF-Speak. 'simultaneously' promises protection, opportunity, and prosperity. WEF-Speak is always working for a Con-Game's War against Working-People's creativity, freedoms and prosperity.

Binance, FTX, and the CCP in Hong Kong

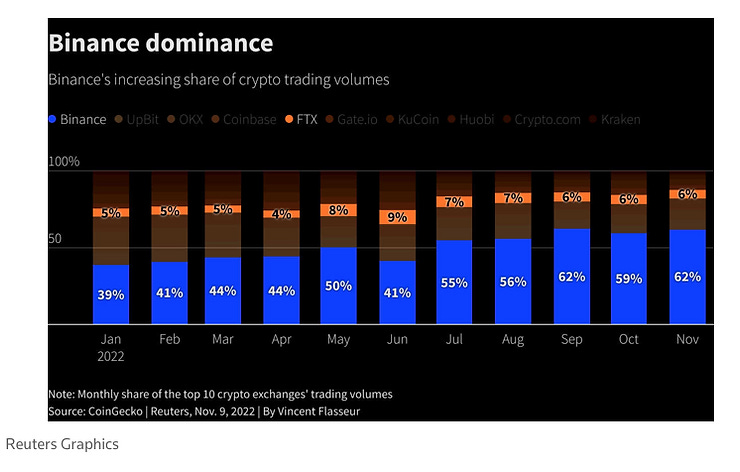

The global entity that has profited most from the 'Downfall' of SBF and FTX is Binance, the 'Crypto-Currency Exchange' headed by its 2017 co-founder, Chengpang ("C Z") Zhao. Binance was dominant, trading more than six times the volume of FTX last June. Binance has subsequently grown from 41% of 'crytpo trading volumes' in June, when FTX was riding high (9%) and itself purchasing rivals for peanuts-on-the-Dollar, to 62% as of November 12. (5)

Binance was in 2019 and 2020 by far the biggest investor in FTX. FTX's Binance's investment raised FTX''s valuation' to $1.2 billion (somehow) in July 2020, about 14 months after FTX began. In 2019 SBF moved to Hong Kong from the San Francisco Bay Area with Caroline Ellison and two other partners, Gary Wang and Nizad Singh.

Zhao and Bankman-Fried in their early partnership.

SBF had a Hedge-Fund, Alameda Research, operational from January 2018 onward, following his two months' stint as Director of Development at The Centre for Effective Altruism. He employed at Alameda Research his fellow stand-out in mathematics and algorithms, Caroline Ellison, born 1994 and a graduate of the University, Stanford, where Bankman-Fried's parents were Law School Professors. Bankman-Friend and Ellison had met while trading Big Tech futures with Jane Street Capital ('a quantitative trading firm and liquidity provider with a unique focus on technology and collaborative problem solving') on Wall Street. Ellison's parents were tenured academics like Bankman-Fried's; Glenn Ellison and Sara Fisher Ellison are Professors of Economics at the Massachusetts Institute of Technology ... the University that graduated SBF with a Degree in Physics in 2014. (6)

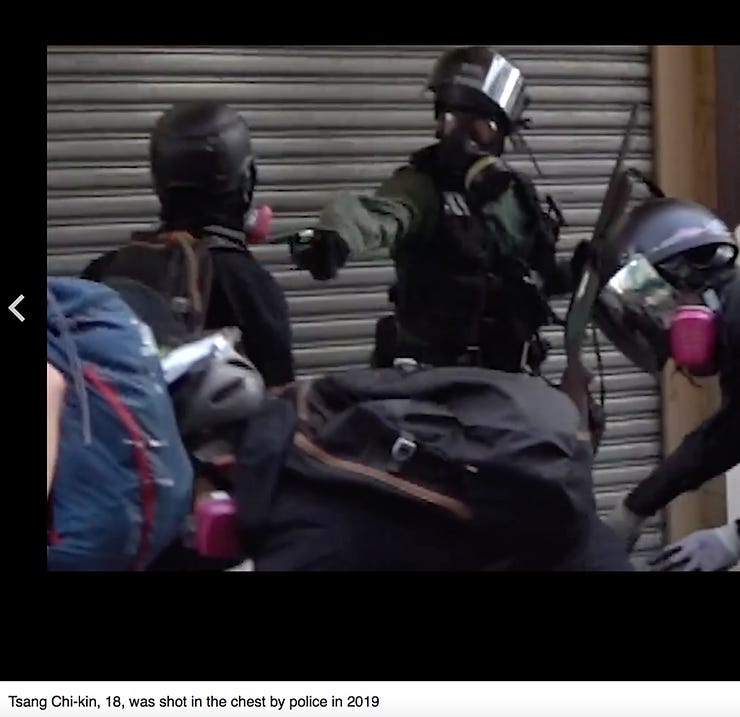

The FTX/Alameda Research team resided in Hong Kong during the 2019 protests (7) that led to pro-democracy candidates winning Election in a November 24, 2019 landslide (8) and then 70% of these winners losing their positions as District Councilors, while the People's Republic of China (Chinese Communist Party) instituted the Hong Kong National Security Law on June 30 of the COVID year 2020. (9)

The Casino Wins and Yet Fails and Falls

FTX prospered in 2021 and into September of 2022.

FTX raised over $1.7 billion in three Rounds between July 2021 and January 2022. Large investors among the 80 that committed to FTX and/or Alameda Research were BlackRock, Sequoia Capital, and the Ontario Teachers' Pension Fund.

The online Silicon Angle reported on January 31, 2022. Again I'll bold within the quote.

'The Bahamas-based cryptocurrency exchange FTX Trading Ltd. today announced it has raised $400 million in new funding in the company’s third fundraise in the past six months, hiking its valuation at a cool $32 billion.

The Series C funding announcement comes less than a week after the announcement of a $400 million Series A funding for the company’s American affiliate FTX US that valued it at $8 billion. According to the company, the same investors participated in both rounds simultaneously.

“Our Series C financing round represents a milestone achievement for FTX, as we raised close to $2 billion in six months,” FTX Chief Executive Sam Bankman-Fried said in a statement. “This round will support our continued mission of delivering innovative products and services to the marketplace as well as expanding our global reach with additional licenses around the world.”

The round saw participation from SoftBank’s Vision Fund 2, Lightspeed Venture Partners, Paradigm, Tiger Global, Steadview Capital, Temasek, Ontario Teachers’ Pension Plan Board, NEA, IVP and Insight Partners. This fundraise brings the total amount raised by FTX to $1.8 billion.

With the funds, FTX intends to continue to build out its global presence by continuing to adhere to regional regulations, said Bankman-Fried. FTX US has already gained the ability to trade derivatives such as futures and options in North America, but FTX itself does not operate in the U.S. As a result, the company’s intent is to expand into Western countries outside the U.S. as much as possible with similar financial products.' (10)

That is, FTX wanted then to establish in 'Crypto' the kind of free-wheeling

Casino across Western countries that the biggest financiers of City of London and Wall Street operate through traditional Stock Exchanges.

Between July 2021 and July 2022, FTX was still rising with Corporate State Big Media approval (SBF on the cover of Fortune magazine's August/September 2022 issue). It was still buying, still winning bids, into September 2022. SBF was portrayed as 'the next Warren Buffett' and a 21st-century J. P. Morgan for his funding and reach into control of foundering crypto-currency companies. (11)

Tim Tolka of Disruption Banking explained.

'For those hit hard by the liquidity crunch in the crypto industry, a white knight with a black afro is on a bargain hunt. The afroman is Sam Blankman-Fried, a 30-year-old crypto billionaire known as “SBF.” His main business is FTX, a crypto exchange in which $10 billion sloshes around on any given day....

With a tight-knit workforce of 300, FTX resisted the hiring spree unlike others like Coinbase and Binance, both of which have around 4,000 head, as well as Crypto.com and Gemini, causing them to rescind job offers and fire staff.

Meanwhile, Forbes described SBF as a “smart vulture capitalist in the beleaguered crypto market,” and Anthony Scaramucci, founder of SkyBridge Capital, called him “the new John Pierpont Morgan” who twice bailed out the financial system back in the early 20th century with his own capital.' (12)

In fact, that 'Corsair' J. P. Morgan of the latter 19th century and early 20th century operated with Capital from Europe-based Banks headed by members of the Rothschild family. This Famous Front died in 1913 with a mere 19% of his Estate owned by his family. (13)

Above is an excerpt from timeline of Financiers' Vampiring of Humanity, printed on the back cover of To Prevent the Next " ' 9/11' ", 2005, a book included in 2008's The World Is Turning: “ ‘9/11’ “, The Movement for Justice, & Reclaiming America for the World.

Caroline Ellison became the sole CEO of Alameda Research in August 2022. She helped to precipitate FTX's 'Downfall' by telling public and easily disproven lies about 'Assets' of FTX and Alameda Research in early days of November. These 'Assets' were then revealed to be FTX's crypto-currency FTT tokens. The FTT's value-per-token was, of course, only the value given it on crypto-currency Markets. Then, Chengpang ("CZ") Zhao publicly sold off at least $585 million of Binance's 'position' in FTT tokens. A further leak from Alameda Research revealed at least $8 billion in A R Liabilities against '$14.6 billion in assets, nearly $6 billion of which was a combination of locked and unlocked FTT tokens.' (14) FTTs tokens fell from $22 to $15. Withdrawals mounted. CZ Zhao stepped in on Tuesday, November 8, with a promising Tweet. He wrote: 'This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire FTX.com....' (15)

SBF thanked CZ in a following Tweet., November 8. 'A *huge* thank you to CZ, Binance, and all of our supporters. This is a user-centric development that benefits the entire industry....' (16)

Next day, Binance backed out of its Letter of Intent, stating that 'issues are beyond our control or ability to help.' On Friday, November 11, FTX filed for Bankruptcy and SBF resigned as CEO. On November 18 Ellison was removed as CEO of Alameda Research and two FTX executives long-close to SBF, Gary Wang and Nishad Singh, were fired by the interim CEO, John J. Ray III, appointed to handle FTX in its Bankruptcy. Ray had also handled the mess following Enron's December 2001 Bankruptcy. (9)

'FTX, the cryptocurrency exchange launched by Sam Bankman-Fried, said it fired three of the founder’s top deputies.

Gary Wang, an FTX co-founder and its chief technology officer; FTX engineering director Nishad Singh; and Caroline Ellison, who ran Mr. Bankman-Fried’s trading arm, Alameda Research, were terminated from those roles after FTX tapped John J. Ray to oversee the companies’ bankruptcy, an FTX spokeswoman said late Friday.

Mr. Bankman-Fried resigned on Nov. 11, when FTX filed for bankruptcy. He was replaced by Mr. Ray, a veteran restructuring executive who once oversaw the liquidation of Enron Corp.

FTX and Alameda sought protection from creditors after executives at both businesses revealed that FTX had lent billions of dollars worth of customer assets to Alameda to plug a funding gap, The Wall Street Journal previously reported.' (17)

C. Z. Zhao then claimed larger roles. By mid-November Zhao was announcing a $1-billion fund to 'rescue' foundering crypto companies (18); encouraging Elon Musk to more adopt a "decentralized" Blockchain model and Crypto-currency trading on Twitter (19); and dismissing his astute critic Nouriel Roubini, the economist who dissected the overeach thievery in City of London/Wall Street Collaterized Debt Obligations in 2008. Zhao characterized Roubini as an "unimportant" person." (20)

ENDNOTES and URLS

1. https://www.cnbcevents.com/wef2022/

2,.https://www.gilmermirror.com/2022/11/14/wef-already-purges-ftx-partner-webpage-but-internet-archive-brings-the-receipts/

3. https://www.lyrics.com/lyric/2134508/Phil+Ochs/Talking+Vietnam+Blues

4. https://www.weforum.org/agenda/2022/11/cryptocurrency-us-midterms/

5. https://www.reuters.com/technology/exclusive-behind-ftxs-fall-battling-billionaires-failed-bid-save-crypto-2022-11-10/

6. https://www.coindesk.com/layer2/2022/11/22/who-is-alameda-researchs-caroline-ellison/

7. https://en.wikipedia.org/wiki/2019–2020_Hong_Kong_protests

8. https://en.wikipedia.org/wiki/2019_Hong_Kong_local_elections

9. https://en.wikipedia.org/wiki/Hong_Kong_national_security_law

10. https://siliconangle.com/2022/01/31/cryptocurrency-exchange-ftx-raises-additional-400m-32b-valuation/

11. https://www.disruptionbanking.com/2022/07/14/sam-bankman-fried-ceo-of-ftx-effective-altruist-is-building-a-crypto-empire/

12. Ibid.

13. The World Is Turning: “ ‘9/11’ “, The Movement for Justice, & Reclaiming America for the World, Irresistible/Revolutionary, 2008, pages 178 and 201, https://www.ur1light.com/the-world-is-turning

14. https://www.trustnodes.com/2022/11/07/billions-withdrawn-from-ftx-nodes-hit-capacity-cz-announces-divorce

15.

16.

17. https://www.wsj.com/articles/bankrupt-ftx-fires-three-of-sam-bankman-frieds-top-deputies-11668825607

18. https://www.bloomberg.com/news/articles/2022-11-14/binance-ceo-cz-zhao-bids-to-replace-ftx-s-sam-bankman-fried-as-crypto-savior

19.

20.